OFFICE OF COMMUNITY DEVELOPMENT

SMALL BUSINESS RELIEF GRANT PROGRAM

In response to the economic hardship experienced by small businesses resulting from the COVID-19 pandemic, the

County of Rockland is launching the Small Business Relief Grant Program. The goal is to keep businesses open and

retain jobs. It is a grant program in response to businesses that are at-risk of closing or laying off employees due to

social distancing policies and other orders and policies related to COVID-19.

Funding Source: County of Rockland’s HUD Community Development Block Grant (CDBG-CV) Program in the amount

of $600,000.

Funding Amounts: A maximum of $45,000 per business, based upon need. Minimum request is $5,000.

Application Request: Applications will be accepted until grant money is exhausted.

PROGRAM REQUIREMENTS

Basic Eligibility:

• For-Profit business located within the County of Rockland Jurisdictional Area of the Urban County as listed in

the 2019 Action Plan submitted to HUD that has been impacted by the COVID-19 self- isolating period such

as restaurants, coffee shops, bars, entertainment and retail.

• Applicant is 51% + majority owner of business.

• Owner is a qualified low/moderate income household (for businesses with no more than 5 employees),

business commits to retain at least one Full Time Job held by a low/moderate income household or business

is located in low/moderate income area as determined by the ACS data as provided by HUD.

• Owner is 18 years or older.

• Owner has a valid Social Security #, EIN & DUNS and Business Bank Account.

• Owner is not currently in bankruptcy.

• Owner is current with all local, state, and federal taxes, fees, and any other debt payments to the County of

Rockland.

• Business has active liability and (if required) Workers Compensation Insurance or will acquire within 30 days.

• Can provide financial evidence of potential job loss resulting from COVID-19.

• Can provide evidence of being able to retain jobs for at least 6 months as a recipient of the grant.

• Not have a conflict of interest with the County of Rockland.

Terms:

• Maximum Request of $45,000, to be evaluated based upon need.

• Minimum Request of $5,000.

• Project report provided to the Office of Community Development within 30 days of first drawdown.

• Project report provided to the Office of Community Development within 60 days after final drawdown is

completed.

Fees:

• Application Fee: NONE

PROGRAM SERVICE AREA

Financing under this program is available to eligible for-profit businesses registered and located within the County of

Rockland jurisdictional boundaries. The location of the business must be in an area of Rockland County that is a part

of the Urban County as listed in the 2019 Action Plan submitted to HUD.

FUNDING SOURCE AND REIMBURSEMENT

The Small Business Relief Grant Program is funded through Community Development Block Grant funds provided by

the U.S. Department of Housing and Urban Development through the CARES Act. The funds are known as CDBG-CV.

The funds were provided to County of Rockland Office of Community Development and these funds have federal

requirements. The federal requirements cannot be waived or otherwise changed by the County of Rockland.

Funds will be disbursed by reimbursement to the applicant for documented eligible project expenses or in some

carefully reviewed rare and eligible instances, to third party vendors for purchase orders.

ELIGIBLE APPLICANTS

• For-profit businesses with up to twenty-five (25) employees at the time of application submission may apply,

subject to restrictions set forth in 24 CFR 570.203 regarding Special Economic Development projects.

• Eligible applicants located within the County of Rockland Jurisdictional Area of the Urban County as listed in

the 2019 Action Plan submitted to HUD

INELIGIBLE APPLICANTS

An ineligible existing business applicant is one that has a physical business locations or registration outside

of the County of Rockland Jurisdictional Area of the Urban County as listed in the 2019 Action Plan submitted

to HUD.

• Nonprofit organizations are not eligible businesses and will not be considered for funding.

• Individual K-12 schools (public or private)

• Political Activities, Civic Organizations

• Chain restaurants and franchises

• Other ineligible businesses include payday grant businesses, liquor and tobacco stores, pawn shops, firearm

or other weapons dealers, adult entertainment, passive real estate investments or home-based businesses

operating without appropriate zoning and/or permits.

• Organizations that discriminate based on race, culture, gender, sexual orientation, age, or religion.

ELIGIBLE USE OF FUNDS

The County of Rockland Office of Community Development will review the project scope of work submitted in the

applications. Grants are restricted to certain eligible costs, especially those related to basic operating capital for

leasing space, insurance and/or utilities and staff salaries. As secondary requests, the County will also consider

requests for inventory, supplies, furniture, software, construction costs less than $2,000. All requests must be

accompanied by an explanation as to how these purchases are due to the COVID-19 pandemic.

• Purchasing inventory, supplies, accounting and inventory software, furniture, fixtures, and equipment.

• Rehabilitation of owner-occupied or leased space (maximum $2,000 construction costs).

• Professional services including engineering, architectural, local permits or fees, business consulting services;

as pre-approved by County CD staff.

• Equipment purchase (with or without installations costs)

• Marketing materials and advertising including website development and servicing

INELIGIBLE USE OF FUNDS

In addition to CDBG-ineligible costs outlined in 24 CFR 570, funds under this Small Business Relief Grant Program

may not be used to:

• Pay off non-business debt, such as personal credit cards for purchases not associated with the business.

• Purchase personal expenses such as buying a new car or making repairs to an applicant’s home.

• Direct financing to political activities or paying off taxes and fines.

• Purchase personal items or support other businesses in which the borrower may have an interest.

• Construction fees over $2,000.

APPLICANT CAPACITY

The County must confirm that the business and the applicant(s) possess the capacity to execute the project proposal

to be successful with the use of CDBG funds. Grant applicants for the program are required to demonstrate

management capacity and ability to successfully operate a business through their applications.

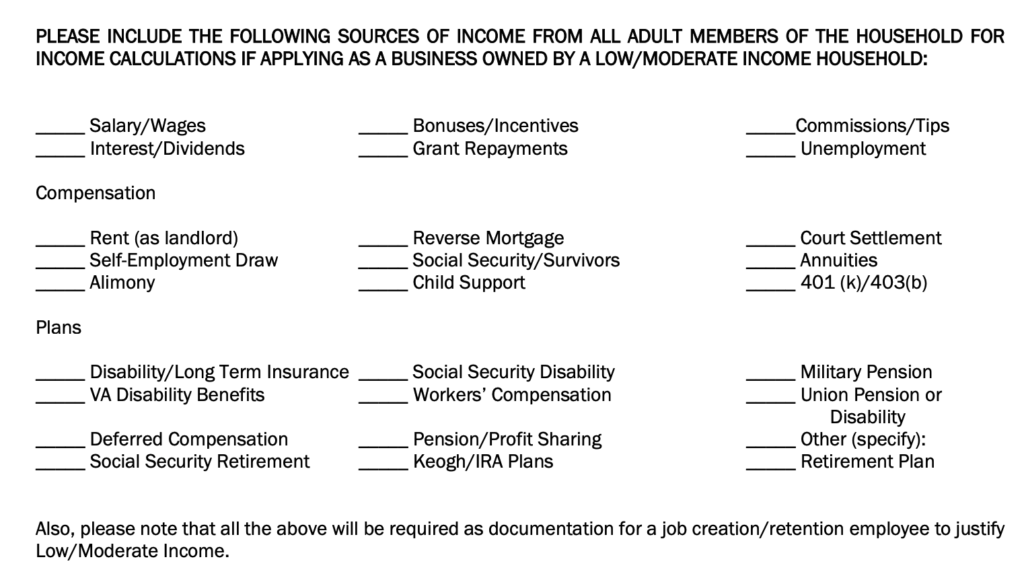

JOB RETENTION/CREATION

Priority will be given to applicants that commit to retaining employees or jobs. Unless a business applicant’s owner is

a member of a low/moderate income household and the business qualifies as a HUD defined microenterprise, then

retention or creation of at least one job held by a low/moderate income household is required to access funds in the

Small Business Relief Grant Program. Job retention is defined as a total full-time equivalent positions at 40 hours per

week, or a combination of part-time positions combining for 40 hours per week, including owners. At least 51% of the

positions retained or created must be held by employees who are a member of a low/moderate income household.

PROGRAM DETAILS

GENERAL CREDIT REQUIREMENTS

Outstanding Taxes, Fines and Fees – Outstanding debts from municipal citations, child support, taxes owed to federal

and state agencies, and delinquent property taxes do not disqualify applicants IF proof of formal payment arrangement

is provided.

Traditional Credit – If an applicant feels it will strengthen their application, they may elect to submit personal credit

information. Otherwise, this is not required.

OTHER REQUIREMENTS OF HUD SOURCED GRANTS

Grant Applicants must:

• Provide a valid DUNS number and CAGE code

• Allow the County to complete an Environmental Review (NEPA) before providing funds

• A GRANT APPLICANT MUST NOT BE LISTED ON THE FEDERAL DEBARRED LIST (SAM Search)

PROGRAM ADMINISTRATION

The County of Rockland Office of Community Development will:

• Market the Small Business Relief Grant Program

• Accept and process applications

• Complete an Environmental Review

• Complete Income Eligibility qualification and document number of employees

• Ensure timely disbursement of funds

• Maintain agreement documents and fiscal records

• Administer the CDBG-CV Grant that is used for this program

• Ensure compliance with program guidelines

• Collect, review, and provide annual program updates

GRANT TERMS AND CONDITIONS

Financial assistance from the program is designed to keep businesses operational and retain jobs. Terms and

conditions are determined by material submitted in the application.

• Grant – the funding is in the form of a grant. The business must be able to provide evidence of job retention

for at least 6 months, if this is the type of acceptance to receive the grant, otherwise the funds must be repaid

to the County of Rockland Community Development Office. This evidence must be in the form of payroll

records. A copy of the handwritten/typed check and stub that was issued to the employee each week is not

considered a payroll record.

• The County of Rockland must be allowed to collect certain income and demographic data from applicants and

their employees.

• The County of Rockland must be allowed to collect 3rd party documentation such as financial information that

demonstrates potential business closure or layoff.

• Maximum grant award of $45,000.

• No Application Fee.

PROGRAM OPERATIONS AND GRANT PROCESSING

PROGRAM MARKETING AND OUTREACH

Program marketing will be conducted by the County of Rockland and will affirmatively target women and minorityowned enterprises. Examples of marketing include a public notice in the local newspaper, posting on the Rockland

County Government website, notification to all Consortium towns and villages for referral to Community Development

for this program and other entities that may be used as a referral agency.

EQUAL OPPORTUNITY COMPLIANCE

The Rockland County Small Business Relief Grant Program will be implemented consistent to the County’s

commitment to State and Federal Equal Opportunity Laws. No person or business shall be excluded from participation

in, denied the benefit of, or be subjected to discrimination under any program or activity funded in with CDBG-CV

Program Funds on the basis of his or her religion, religious affiliations, age, race, color, ancestry, national origin, sex,

marital status, familial status (number of ages of children), physical or mental disability, sexual orientation or other

arbitrary cause.

APPLICANT CONFIDENTIALITY

All personal and business financial information will be kept confidential to the extent permitted by law. Emergency

Fund participant files with personal and business confidential information will be kept separate from other funding

files and will not be available for review by anyone not responsible for the administration of the grant relief fund.

DISPUTE RESOLUTION/APPEALS PROCEDURE

Applicants whose applications are not selected or not deemed eligible have the right to appeal the decision of the

county, limited to procedural errors in the selection process. If no such procedural errors are found to have occurred,

the decision of the county shall be final. An applicant may, within seven (7) business days after denial of grant, appeal

in writing to the Director of Community Development or their assigned designee. The appeal must state all facts and

arguments upon the appeal is based. The Director or assigned designee, will review the Small Business Relief Grant

Program Guidelines, the grant application, and the facts of the appeal. The Director or assigned designee will render

a written decision within thirty (30) business days of the receipt of the appeal.

EXCEPTIONS/SPECIAL CIRCUMSTANCES

The County of Rockland reserves the right, at its sole discretion to deviate from County-imposed policies and

procedures in extenuating circumstances. A request for exception to program guidelines shall be submitted to the

Office of Community Development in writing by the applicant. Exceptions are defined as any action which would depart

from policy and procedures stated in the guidelines.

GRANT CLOSING PROCESS

Upon successful completion of application process, staff will prepare for the grant closing by having the attorney

prepare the grant closing documents. After closing, the applicant submits invoices to request reimbursement funds

from the County. Community Development staff will review invoice requests and initiate the reimbursement payment

process. CDBG-CV Funds will be disbursed by reimbursement to the applicant for documented eligible project

expenses or in some carefully reviewed rare and eligible instances, to third party vendors for purchase orders.

APPLICATION REVIEW

Applications to the Small Business Relief Grant Program are presented by business owners/agents to Rockland County

Office of Community Development staff. ALL the information submitted for review must be signed and dated. This

includes all attachments. Sign and date all documents included with the application. Top scoring applications will be

recommended for approval, until all funding is exhausted. CD staff will keep a spreadsheet of all business names,

addresses, amount of approved grant, reimbursement requests and payments.

Contracts for approved grant applications will be drafted by County Legal staff and circulated for proper signatures.

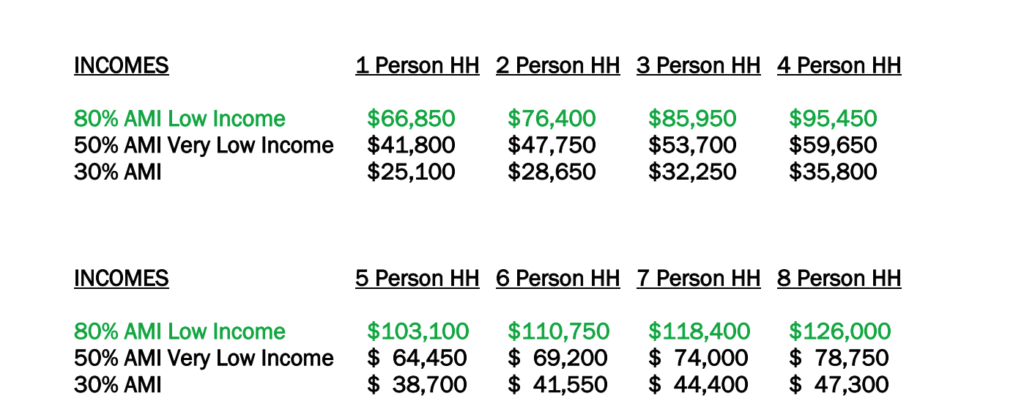

APPENDIX A

2021 HUD LOW/MODERATE INCOME THRESHOLD

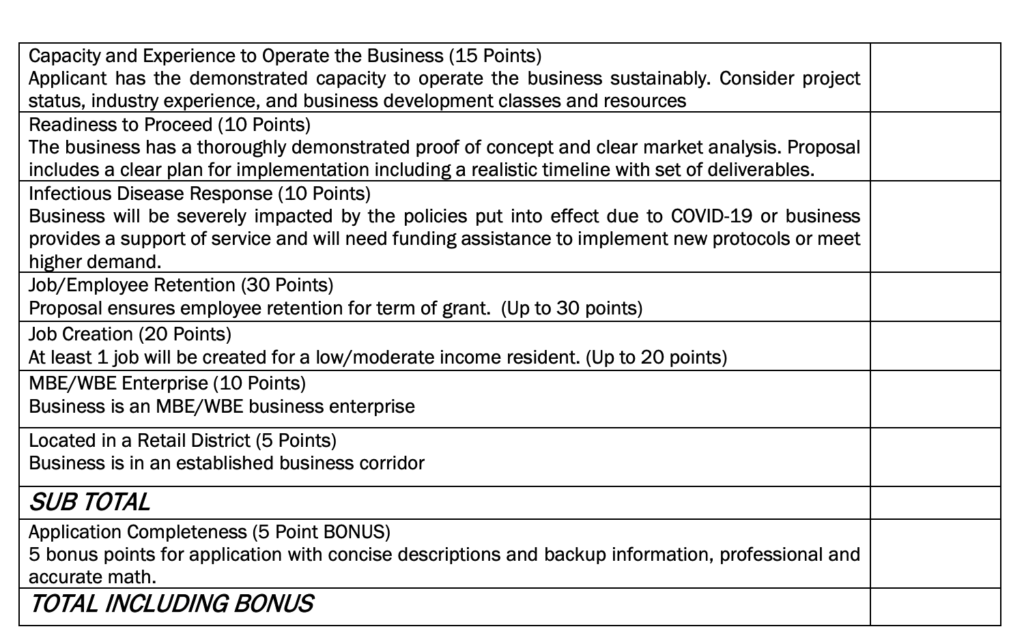

APPENDIX B

CDBG-CV SMALL BUSINESS RELIEF GRANT PROGRAM

SCORING MATRIX

If the proposed project meets all threshold criteria, County of Rockland Community Development Staff will utilize the

following project scoring criteria to evaluate the application for the purpose of determining priority of project

application versus other projects competing for grant funds. The highest scoring projects will be funded first.

This table is provided as a reference and will be completed by program staff.

HELPFUL LINKS

Dun & Bradstreet – DUNS – https://www.dnb.com/duns-number/get-a-duns.html

Cage code – https://www.sam.gov/SAM/

Federal EIN – https://www.ris.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identificatinnumber-ein-online